Retirement is a significant milestone in life and something that most people plan for. But, unfortunately, the reality of retirement can be quite different from the dream. It can be hard to secure your golden years without a proper retirement plan. Working with life insurance agencies can be beneficial. These agencies specialize in helping people plan for retirement and can provide advice and guidance on the best investments, savings methods, and more.

What Is Life Insurance?

Life insurance is a contract between an insurance company and a person. This contract gives a fixed sum or a series of payments upon the insured individual’s death. In many circumstances, life insurance can be converted into an income-generating annuity. This sort of insurance protects the insured’s family financially.

How Can Life Insurance Agencies Help with Retirement Planning?

As mentioned above, life insurance policies provide a financial safety net for the policyholder and their family. This makes them an excellent option for those planning and saving for retirement. In addition, life insurance agencies can advise on which type of policy best suits an individual’s retirement goals.

The most vital thing to remember is that life insurance policies can help protect retirement savings from market volatility. This is because life insurance policies are not subject to market fluctuations and can provide a guaranteed retirement income.

In addition to protection from market fluctuations, life insurance agencies can advise on investments and strategies to help maximize their retirement savings. With the help of a professional, an individual can make informed decisions about investments and find the best ways to save for retirement.

How Can Life Insurance Agencies Help with Retirement Planning?

As mentioned above, life insurance policies provide a financial safety net for the policyholder and their family. This makes them an excellent option for those planning and saving for retirement. In addition, life insurance agencies can advise on which type of policy best suits an individual’s retirement goals.

The most vital thing to remember is that life insurance policies can help protect retirement savings from market volatility. This is because life insurance policies are not subject to market fluctuations and can provide a guaranteed retirement income.

In addition to protection from market fluctuations, life insurance agencies can advise on investments and strategies to help maximize their retirement savings. With the help of a professional, an individual can make informed decisions about investments and find the best ways to save for retirement.

The Benefits of Long-Term Planning

When you plan for retirement early, you can take advantage of compounding and long-term investing. Compounding is when you reinvest your gains, making your assets more valuable. Long-term investing also allows you to take advantage of the market’s natural growth over time.

Life insurance agencies can help you create a portfolio that takes advantage of these benefits. In addition, they can help you analyze your risk tolerance and recommend investments that are best suited to your needs. This way, you can maximize your retirement savings while minimizing your risk.

Using a life insurance agency can also help you with the legal aspects of retirement planning. For example, they can help you review your estate plans and ensure that your assets are allocated correctly. This way, you can ensure your estate is adequately protected in case of death.

Tax Benefits

Another benefit of working with a life insurance agency is the potential for tax savings. Some life insurance policies, such as permanent life insurance, offer tax-free growth of the policy’s value. This means that the policyholder can accumulate more wealth over time and use it to supplement their retirement income.

In some cases, the policyholder may be able to borrow against the policy’s death benefit. This can be used to cover medical expenses or other costs associated with retirement. The policyholder can also use the borrowed funds to supplement their retirement income.

Finally, life insurance policies can also be used to pass on wealth to loved ones. The policyholder can designate a beneficiary who will receive the death benefit upon their death. This can be a powerful way to ensure family members are provided for after the policyholder is gone.

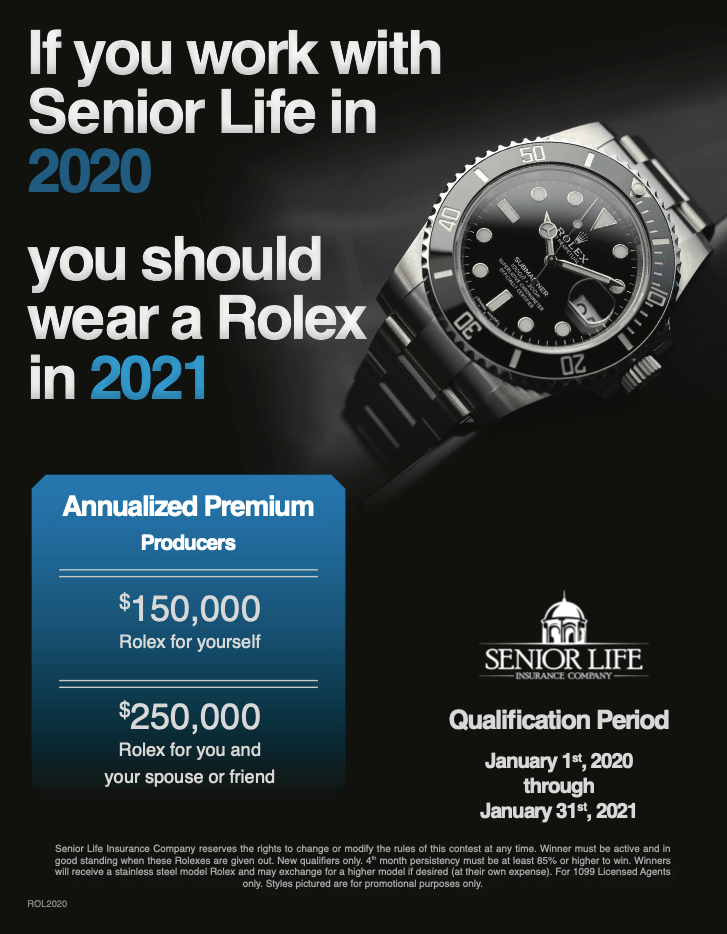

With Senior Life Insurance Company, you have the chance to earn your own Senior Life Insurance Company ring based on your production.

With Senior Life Insurance Company, you have the chance to earn your own Senior Life Insurance Company ring based on your production.