Insurance agents play a crucial role in the U.S. life insurance industry. Knowing how to become an insurance agent can open the door to an extraordinary and rewarding career. Agents provide insight and advice at a time when customers need it the most. As a result, a qualified and experienced agent offers excellent value to customers and insurance companies alike.

Becoming an insurance agent is a great way to help others protect their financial well-being and earning potential. To become an insurance agent, you’ll need to complete the necessary education and licensing steps and demonstrate that you’re a knowledgeable and reliable insurance professional. This article will provide a comprehensive guide to becoming an insurance agent in the United States.

What Does an Insurance Agent Do?

An insurance agent is responsible for selling and servicing policies to customers. Therefore, they must have a strong knowledge of the different types of insurance available and be able to explain the features and benefits of each policy to their clients. Agents also manage claims for their clients and assist them with filing paperwork and collecting payments.

In addition to selling insurance policies, agents also work with clients to ensure that their policies are up to date and that they are being adequately serviced. This includes providing policyholders with information about their policies, helping them to understand their coverage limits, and answering any questions they may have.

Qualifications to Become an Insurance Agent

To know how to become an insurance agent, you must know what qualifications you need to meet. This qualification includes education, licensure, and training. Although requirements may vary by state, here’s what you’ll need to get started:

Education

Insurance agents must have a high school diploma or equivalent, although some states may require additional education.

Licensure

Every state requires insurance agents to obtain a license to practice. You must complete a licensing exam to become a licensed insurance agent. The specific requirements for licensure vary by state, so be sure to check with your state’s Department of Insurance for more information.

Training

In addition to education and licensure, most insurance companies require agents to complete specialized training to become familiar with their products. This training is usually completed in-house or through an external training provider.

Continuing Education

Insurance agents must also complete continuing education courses to maintain their licensure. Depending on the state, this can include completing a certain number of hours of courses or attending specific classes. Again, it’s essential to check with your state’s Department of Insurance to determine the particular requirements.

Skills Needed to Become an Insurance Agent

In addition to the qualifications mentioned above, becoming a successful insurance agent also requires specific skills and qualities.

Interpersonal Skills

Insurance agents must be able to build relationships and trust with their clients.

Communication Skills

Insurance agents must clearly explain insurance policies and coverage options to their clients.

Detail-Oriented

Insurance agents must be able to thoroughly review and analyze policy coverages to ensure their clients are adequately protected.

Problem-Solving Skills

Insurance agents must be able to provide solutions to their client’s insurance needs.

Selling Skills

Insurance agents must be able to market and sell insurance products to potential clients effectively.

Advantages of Being an Insurance Agent

As an insurance agent, you’ll have the autonomy to work independently and build your own client base. In addition, agents are typically self-employed, allowing them to set their hours and work from home.

There are also financial benefits to becoming an insurance agent. Insurance agents typically receive compensation in the form of commissions. The more policies they write, the more money they make.

Lastly, insurance agents are satisfied knowing they’re helping people protect their property and families.

Steps to Becoming an Insurance Agent

To become an insurance agent, you must complete the following steps:

1. Complete the Necessary Education

To become an insurance agent, you must first finish the relevant educational qualifications. To become an insurance agent in the United States, you must have a high school diploma or equivalent. If you have a college degree, that’s even better. College degrees in business, finance, or risk management benefit this career.

2. Obtain Your License

To become an insurance agent, you must obtain a license from your state’s insurance department. Each state has its licensing requirements, but you must generally pass a test and complete a criminal background check before becoming an insurance agent. You can find more information about licensing requirements in your state on the National Association of Insurance Commissioners’ website.

3. Develop Your Knowledge

Insurance agents are expected to be knowledgeable about the different types of insurance and the laws that govern the insurance industry. You should become familiar with the insurance offered by other firms, as well as the rules and regulations that regulate the industry. You should also become familiar with the types of policies available and the process of filing claims.

4. Expand Your Skillset

To become a successful insurance agent, you must communicate effectively with clients, understand their needs, and explain insurance products in a way that’s easy to understand. You should also have excellent customer service skills and be comfortable using technology and other tools to help you get the job done.

5. Develop Your Network

Insurance agents must have an extensive network of contacts to succeed. You should build relationships with other insurance agents and industry professionals. You should also attend insurance industry events and conferences to stay current on the latest developments.

6. Get Experience

Experience is an integral part of becoming an insurance agent. You should look for internships and entry-level positions that will give you a chance to gain experience in the insurance industry.

7. Obtain Your Certification

Most states require insurance agents to obtain certification from an organization such as the Chartered Property Casualty Underwriter Society of America (CPCU). Obtaining this certification will demonstrate that you have the necessary knowledge and skills to become an insurance agent.

Career Opportunities in Insurance

Once you become an insurance agent, you will have various career opportunities. Many agents specialize in a particular type of insurance, such as life or health insurance. Others may focus on a specific industry, such as auto or business insurance.

No matter what your career path is, you will be able to work with various clients, including individuals, families, and businesses. You will be able to develop relationships with these clients and provide them with the advice and assistance needed to make sure that their insurance policies provide the coverage they need.

Working with an Established Agency

Many insurance agents opt to work with an established insurance agency. This can give you the support and guidance you need to succeed. For example, you can receive advice on setting appointments, marketing your services, and more. Working with an established agency can also help you build a strong customer relationship.

Finding an Agency

Finding the right agency to work with is essential when deciding to become an insurance agent. The Cook Group is an excellent choice when looking for an agency with a broad range of insurance products. Our comprehensive services and support will help you build your business, set up policies, and provide the means you need to succeed.

Working with The Cook Group

The Cook Group is an established insurance agency with more than eight years of experience. We specialize in giving our clients the best life insurance products available. Our team of experienced agents is trained to provide customers with the best advice and service.

Whether you are looking for answers on how to become an insurance agent or seeking a whole life insurance policy or a term life insurance policy, our agents can help you find the perfect one for your needs. Of course, we also offer various other services, such as health insurance, auto insurance, and more. For more information, please visit our website or contact us directly.

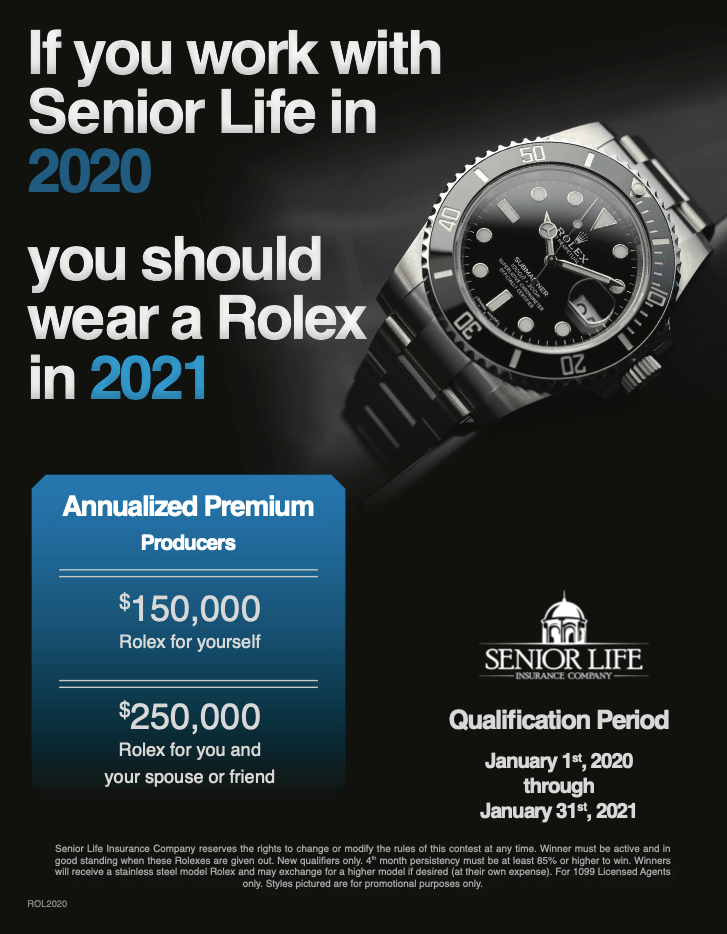

With Senior Life Insurance Company, you have the chance to earn your own Senior Life Insurance Company ring based on your production.

With Senior Life Insurance Company, you have the chance to earn your own Senior Life Insurance Company ring based on your production.