If you’re considering a career in life insurance sales, it’s essential to understand the qualities that make a life insurance agent successful. While many factors contribute to success, there are five essential qualities that top-performing agents possess. In this article, we’ll explore these qualities and provide examples of how they’re applied in the industry.

What is the importance of Life Insurance Agents?

Life insurance agents play an essential role in the insurance industry by helping individuals and families protect themselves financially against unforeseen events such as death, disability or illness.

- Expertise and advice: A life insurance agent is trained and licensed professionals who have knowledge and expertise in the insurance industry. They can provide advice on the types of policies available, how much coverage is needed, and what features and benefits to look for based on the individual’s specific needs.

- Customized solutions: Life insurance agents work closely with clients to understand their unique financial situation and goals, and then help them choose the policy that best fits their needs.

Assistance with claims: In the unfortunate event of a claim, a life insurance agent can provide valuable assistance and support to the policyholder or beneficiary. - Long-term relationships: A life insurance agent often establish long-term relationships with their clients, providing ongoing support and advice as their needs and circumstances change over time.

What are the Qualities of Highly Successful Life Insurance Agents?

1. Strong Work Ethic

A strong work ethic is a set of values and principles that guide a person’s approach to work, which includes qualities such as reliability, responsibility, accountability, diligence, professionalism, and a commitment to excellence. People with a strong work ethic are motivated, reliable, consistent, take responsibility for their actions, and are committed to continuous learning and improvement. It is an essential factor for success in any profession and highly valued by employers and colleagues.

Why is a strong work ethic important in building trust with clients?

- Consistency: A strong work ethic ensures that you consistently provide high-quality service to your clients. When clients can count on you to deliver what you promise, they are more likely to trust you.

- Reliability: A strong work ethic means that you are reliable and dependable. You follow through on commitments, meet deadlines, and are responsive to your clients’ needs. When clients know they can count on you, they are more likely to trust you.

- Honesty: A strong work ethic includes honesty and integrity. When you are transparent and truthful in your dealings with clients, they are more likely to trust you.

- Competence: A strong work ethic means that you are committed to improving your skills and knowledge. When clients see that you are competent and knowledgeable about your field, they are more likely to trust you.

- Dedication: A strong work ethic includes dedication and hard work. When clients see that you are dedicated to providing the best possible service, they are more likely to trust you.

- Empathy: A strong work ethic includes empathy and the ability to understand your clients’ needs and concerns. When clients feel that you understand their situation and are working in their best interest, they are more likely to trust you.

2. Effective Communication Skills

Effective communication skills are essential for life insurance sales agents to succeed in their job. It helps them build rapport, explain complex concepts, address objections, close sales, build relationships, and handle difficult conversations. They need to listen actively, show empathy, respond appropriately, and explain insurance policies in simple terms. By developing good communication skills, sales agents can establish client trust, provide personalized solutions, and achieve their sales goals.

Examples of effective communication techniques:

- Active Listening: Paying full attention to what the client is saying, clarifying their doubts, and responding appropriately.

- Empathy: Showing understanding and concern for the client’s needs, feelings, and perspective.

- Open-Ended Questions: Asking questions that encourage clients to elaborate on their thoughts, feelings, and needs.

- Plain Language: Using simple and easy-to-understand terms when explaining complex insurance concepts.

- Non-Verbal Communication: Using body language, such as eye contact, gestures, and facial expressions, to convey interest and understanding.

- Positive Tone: Using a tone that is friendly, respectful, and professional to put the client at ease.

3. Knowledge of the Industry

Industry knowledge is essential for insurance agents to provide accurate advice, stay updated with industry changes, improve customer service, identify new opportunities, and build trust with clients. Agents with deep understanding of the insurance industry can guide clients on making informed decisions, quickly answer their questions, and address their concerns.

By staying up-to-date with industry trends and regulations, agents can identify new opportunities for their clients and provide advice on ways to optimize coverage and minimize risk. This knowledge also helps build trust with clients who are more likely to trust agents that demonstrate a deep understanding of the insurance industry.

4. Adaptability

Adaptability is adjusting to new situations, changes, and challenges. In the insurance industry, adaptability is essential because the industry is constantly changing. Adaptable insurance agents can quickly adjust to new trends, policies, and regulations and stay ahead of the competition.

Here are some reasons why adaptability is important in the insurance industry:

- Keeping up with industry changes: The insurance industry constantly evolves with new policies, regulations, and market trends. Adaptable agents can quickly adjust to these changes and adapt their strategies to stay ahead of the competition.

- Meeting clients’ changing needs: As clients’ needs change, insurance agents must adapt to provide the best solutions. Adaptable agents can quickly adjust to meet clients’ changing needs and provide personalized solutions that meet their unique requirements.

- Identifying new opportunities: Adaptable agents can identify new opportunities and market trends that can benefit their clients. They can also provide advice on ways to optimize coverage and minimize risk.

- Improving customer service: When agents are adaptable, they can provide better customer service by quickly addressing clients’ needs and concerns. Adaptable agents can adjust their approach to meet each client’s unique needs and preferences.

- Building trust: When agents are adaptable, it builds trust with clients. Clients are more likely to trust agents who can quickly adapt to changes in the industry and provide informed advice.

5. Empathy

Empathy is the ability to understand and share the feelings of another person. In life insurance sales, empathy is crucial for building rapport and trust with clients. When agents can empathize with clients, they can better understand their concerns, needs, and priorities, and provide personalized solutions that meet their unique requirements.

- Improved relationships: Empathy can help us build better relationships with others. When we are able to understand and connect with others, we can communicate more effectively and resolve conflicts more easily.

- Increased emotional intelligence: Empathy is a key component of emotional intelligence. It allows us to be more aware of our own emotions and those of others, which can help us make better decisions and navigate social situations more effectively.

- Greater understanding of diversity: Empathy helps us appreciate diversity and understand people from different backgrounds and cultures. It can help break down stereotypes and prejudice, and promote inclusivity and equality.

- Enhanced leadership skills: Empathy is an essential skill for leaders. When leaders can understand and relate to the people they lead, they can inspire and motivate them more effectively.

- Improved mental health: Empathy can also have positive effects on our own mental health. When we are able to connect with others and understand their emotions, we can feel more connected and less isolated.

Putting it all Together

The qualities that are important for success in any industry include strong work ethic, adaptability, knowledge of the industry, effective communication skills, collaboration, and empathy. Being able to adapt to change, collaborate effectively with others, and understand and connect with others on a deeper level can help individuals stand out, make valuable contributions, and achieve their goals in today’s competitive industry.

If you are a business owner, don’t wait until it’s too late to protect your business and assets. Applying for insurance can provide many benefits, such as protection against financial loss, compliance with legal requirements, and increased credibility. By speaking with a professional life insurance agent and choosing the right coverage for your specific situation, you can have peace of mind knowing that your business is protected against unexpected events. So, take action today and apply for insurance at The Cook Group to secure the future of your business.

ALSO READ: How To Find The Best Life Insurance Agents Near Me?

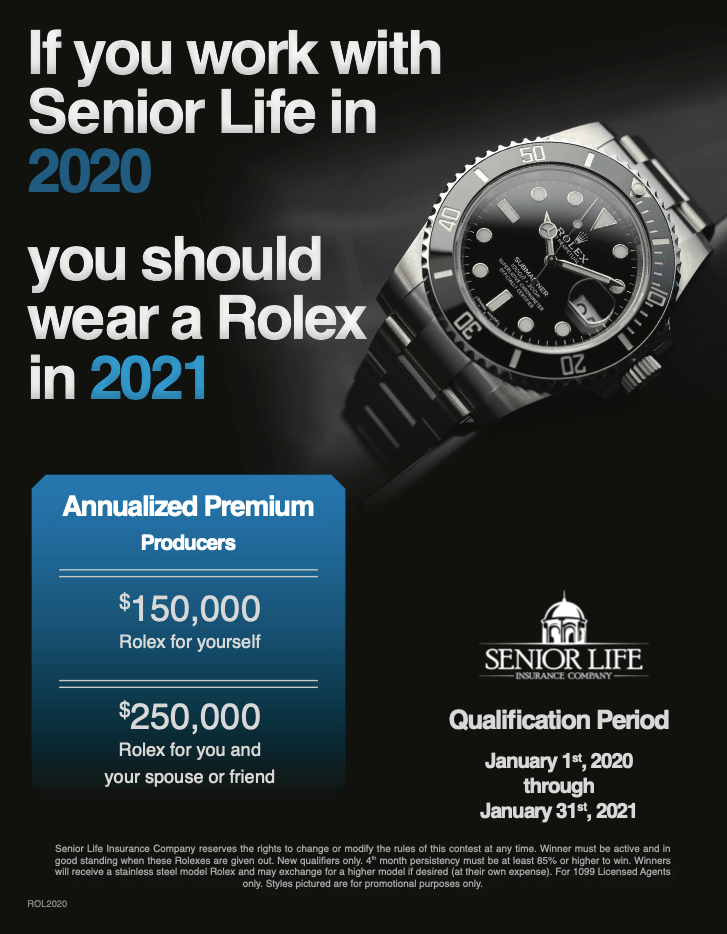

With Senior Life Insurance Company, you have the chance to earn your own Senior Life Insurance Company ring based on your production.

With Senior Life Insurance Company, you have the chance to earn your own Senior Life Insurance Company ring based on your production.