Introducing and Understanding Life Insurance

Life insurance is an important documentation that provides protection to loved ones and a secure financial future in case of an unexpected event such as untimely death, used for potential emergencies.

In relevant detail, the role of a life insurance agent is to help families and clients find the right life insurance policy that fits their target need and budget, they act as a mediator between the insurance company and the policyholder and offer guidance and advice throughout the process.

It is necessary to have a life insurance agent in providing services and assistance in obtaining and finding the important insurance in preparation for an unexpected and untimely predicament.

Understanding Life Insurance

To understand the services that life insurance agents will provide. It is important to understand that there are several types of life insurance policies which the life insurance agent will be helping you secure. Here are 2 main types of insurances:

Term Life Insurance

A type of insurance that provides coverage for a specific period of time, usually ranging from 1 to 30 years, stating that the beneficiaries receive a death benefit if the policyholder passes away during these terms.

Permanent Life Insurance

A type of insurance that provides coverage for the policyholder’s entire life, this insurance has cash value that will grow over time and is typically more expensive.

The Benefits of Working with a Life Insurance Agent

Personalized Service and Attention

Life insurance agents are there to provide services to one or a few clients, this makes them more attentive and fully focused on assisting the client at all times.

Knowledge of Local Market and Regulations

Life insurance agents have knowledge about the local market and area regulations. This makes them easy to depend on when being around an unfamiliar area or when searching for the right life insurance provider.

Availability for Face-to-Face Consultations

Life insurance agents make themselves and their time available for necessary face-to-face consultation and meeting as their top priority and necessity.

What to Look for in a Life Insurance Agent

Life Insurance agents have huge responsibilities in providing their services to clients in regards to such important documents. With this, there are things to consider when looking for a life insurance agent near you.

Licensing and certification requirements

Because of the complex and multiple responsibilities they hold when providing their services. It is necessary that they have official licenses and certifications in order to document their legitimacy.

Industry experience and knowledge

Agents need to be knowledgeable and experienced in the field of life insurances and related policies in order to help clients who may not be able to learn the entire type of policies.

Professionalism and ethical standards

Agents would need to be professional and have standards in assisting and guiding their clients during the process of finding and obtaining life insurance.

Accessibility and availability

Life insurance agents should be accessible within the preferred location and should be available when they are called into the client’s service.

Communication Skills and Responsiveness

Agents need to have great communication skills for better understanding and should be responsive whenever a client needs assistance.

How to Find a Life Insurance Agent Near Me

After considering the qualities and specifications when looking for a life insurance agent. The next thing to consider is finding an agent that is either near the preferred location or has easy access to the location for more convenience. Here are some ways on finding an agent.

Referrals from friends and family

Inquire details and information from any colleagues or family members who may know or have already associated with life insurance agents.

Online resources and directories

Using search engines in internet browsers is a quick and easy way to find any agents/agencies that are available within the location.

Local insurance agencies and brokers

There are also some local agencies and companies that have physical offices in various locations, looking and visiting these local agencies can help provide or refer life insurance agents available.

Avoiding Common Mistakes When Choosing a Life Insurance Agent

Falling for high-pressure sales tactics

It is necessary to set up your savings goals and limit on how much you need to spend in looking for an agent, decline and reject any openings that are forcing sale tactics onto you and just focus on finding an agent that fits your qualifications.

Choosing the cheapest option without considering other factors

There are categories and factors that are needed when considering and choosing a life insurance agent’s services. Do not simply go towards the services that provide the cheapest options, you need to compare their quality of services and details as well.

Failing to review and understand the policy before signing

Read carefully and understand the policies and fine lines in between when signing official papers. You need to have the information of fine details and policies when getting an agent’s assistance.

Conclusion

A life insurance agent can be the best supporting role and assistant when inquiring and obtaining life insurance. Their attention and full focus on their client and services to guide them at all times makes them a reliable source and voice for second thoughts and opinion.

It is important to remember their policies and services as well as what they and they cannot do. They are there to provide necessary help and help choose which insurance is right for you.

If you are looking for an insurance agent near you right now and help prepare for the future. Consider reaching out to us at The Cook Group, where we pride ourselves in delivering rewarding life insurance assistance. Contact us here and get started today!

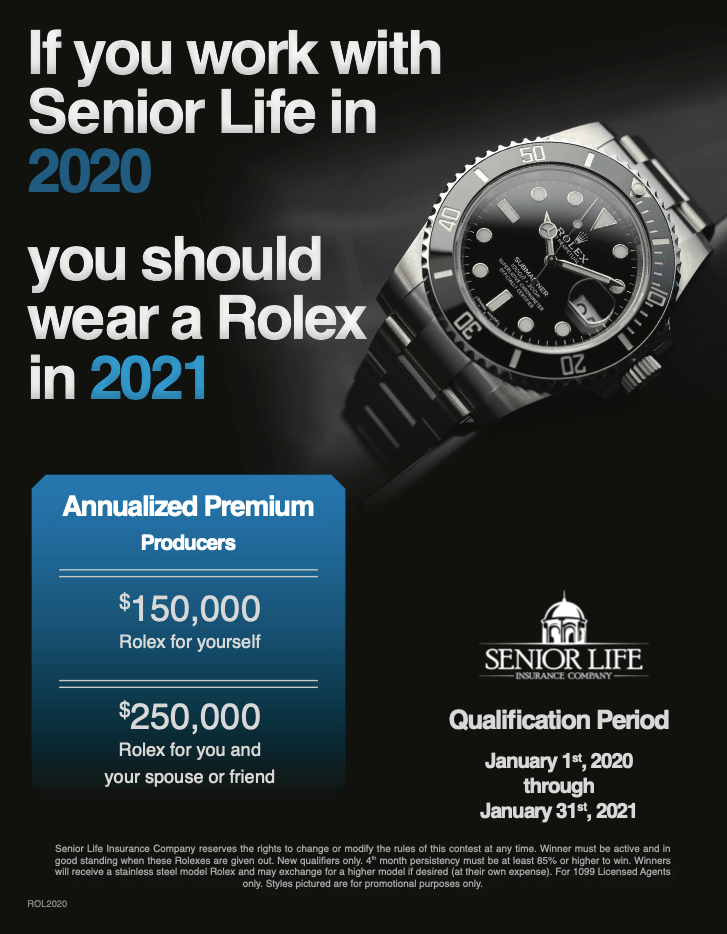

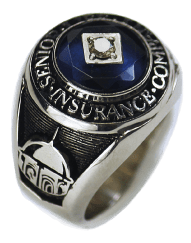

With Senior Life Insurance Company, you have the chance to earn your own Senior Life Insurance Company ring based on your production.

With Senior Life Insurance Company, you have the chance to earn your own Senior Life Insurance Company ring based on your production.