Importance of an Insurance Policy

In order to learn on how to become an insurance agent, it is important to know and understand the policies the role focuses on selling.

It is important for individuals to have and prepare an insurance plan in order to be ready for unexpected events to occur. Insurance industries provide protection against financial losses through the sales of insurance policies, contracts between the insurance company and the policyholder.

The insurance industry generates revenue by assessing premiums from policyholders according to the level of risk associated with their policies. In return, policyholders receive coverage as specified in their insurance policies. The industry has many types of insurance, each covering different risks and provides different levels of protection.

With different types of insurance policies and different providers, this would make potential clients overwhelmed and unable to understand or learn all of these types, this is why there are licensed insurance agents available to provide them such assistance.

Becoming a licensed insurance agent has come with many benefits in their career; this includes career opportunities for growth, income potential, personal development and assistance to others just to name a few.

Eligibility for Becoming an Insurance Agent

There are requirements that are needed to determine if an individual is eligible to become an insurance agent. These requirements include:

Age requirements

Individuals must be at the age of 18 and above to become an insurance agent.

Educational requirements

Industries need documents and recordings of your educational background, commonly a high school diploma or any equivalent.

Pre-licensing course

To sell insurance in their chosen line of business, individuals must successfully complete a pre-licensing education course approved by the state, tailored to the specific type of insurance they wish to offer.

Licensing Exam

Individuals must take and pass a licensing exam that covers insurance principles and state-specific regulations.

Background checks

Individuals are required to have a background check as part of the licensing process.

Other requirements

Some locations would be asking for additional requirements such as medical checks or physical examinations to name a few.

Choose a Type of Insurance to Sell

Insurance agents have specific insurances that they need to be an expert of in order to sell their services to potential clients who wish to obtain certain insurances.

Types of insurance

Future agents need to know the types of insurances and which insurance services they want to provide, here are some of the types of insurances:

Life Insurance

Type of insurance that pays a sum of money upon the policyholder’s death to their designated beneficiaries. This is the most common and important type that has a sub-type of term-life insurance and permanent life insurance.

Health Insurance

Type of insurance that covers the cost of medical care such as doctor visits, hospital stays, and prescription medications.

Auto Insurance

Type of insurance that provides coverage for damages and injuries resulting from vehicle accidents.

Disability Insurance

Type of insurance that provides coverage and income replacement if an individual becomes unable to work due to a disability.

Home Insurance

Type of insurance that protects homeowners against damages to their property and liability claims.

Choosing an insurance specialization

It is important for agents to choose an insurance specialization as it has been seen that there are many types of insurance and specializations for each type. Here are some factors agents can consider when choosing a certain specialization:

Personal Interest

Individuals can choose a specialization depending on their own personal interest and preference.

Compensation

Some specializations may offer different amounts of salary, individuals can use this factor to consider which specific specialization is right for them.

Job demands

Insurance specializations also have a different amount of demands within the market. Individuals who wish to get busy can consider this to choose a specialization that has high demands.

Licensing requirements

Individuals can choose a specialization depending on the licensing difficulties as different types of insurance may require different licenses, with some being harder to obtain than others.

Pre-Licensing Education and Training

A pre-licensing Education are requirements that individuals must fulfill before obtaining an official license in certain fields, by learning the necessary knowledge and skills to succeed in their chosen profession which includes hands-on training and practical experience.

In order to be prepared and equipped with the necessary general knowledge and practical skills required in the line of work, individuals must undergo pre-licensing training based on the specific insurance specialization they need.

Licensing Exams

Licensing training will also prepare agents to take on licensing exams. These exams determine what the agents have learned throughout their training and necessary questions relating to the specialization they have chosen. Passing this exam will provide new agents their results for additional requirements to obtain an official license.

Apply for Insurance Agent License

Potential agents can apply for a license after completing the pre-licensing training and passing the exams. There are also additional requirements for obtaining the licenses such as aforementioned licensing education completion, exam results, filled application form and application fees.

Complete Continuing Education Requirements

Continuing Education requirements are activities that licensed agents must complete and learn in order to maintain their license in good standards by staying up-to-date and understanding of both old and new knowledge updated within their field. This will also help them advance further in their career.

Final Thoughts

It is necessary that these steps are considered for those who want to know how to become an insurance agent. There are certainly a variety of required skill sets and documents to assess, train and prepare potential agents in preparation to sell their services in their chosen insurance field. This article provides details for agents to expect on what they need and must do in the near future of insurance business.

Interested in becoming an agent? Consider joining us at the Cook Group, where you can become a part of our growing team and gain a lot of experience and exposure. Contact us now and get started on being successful in the insurance agency life.

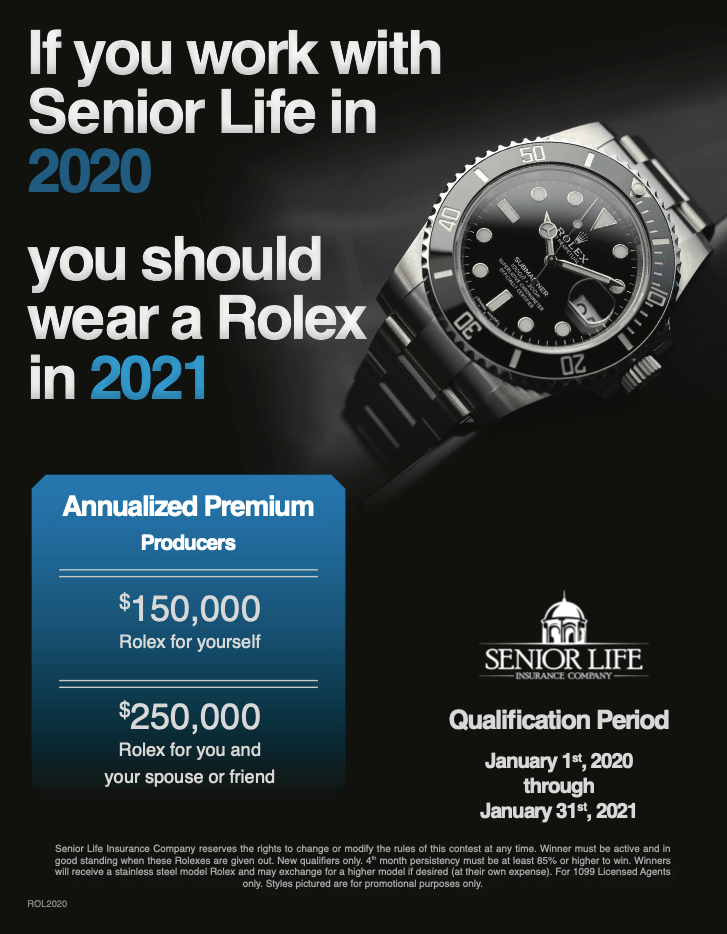

With Senior Life Insurance Company, you have the chance to earn your own Senior Life Insurance Company ring based on your production.

With Senior Life Insurance Company, you have the chance to earn your own Senior Life Insurance Company ring based on your production.