Now that it’s September, it’s time to celebrate Life Insurance Awareness Month or, commonly known as LIAM. This is one of the notable events in the insurance industry where insurance agencies, organizations, and financial advisors gather together to educate individuals and foster awareness about why insurance is beneficial to the population.

Celebrating LIAM is the perfect opportunity for individuals to review their insurance essentials and for their insurance-related concerns to be given answers. Participants can also take the chance to consult financial advisors and learn more about how insurance works. Since various insurance agencies are present, seeking further knowledge about the industry will be a great event.

Insurance may yield long-term or even lifetime benefits. However, some individuals are either not interested in them or need to learn more about insurance, so this article will give you a profound overview of what it is and why Life Insurance Awareness Month also matters.

What is Life Insurance Awareness Month?

Life Insurance Awareness Month (LIAM) was established in 2004 by the nonprofit Life Happens. Life Happens’ goal was to help people get educated and empowered about insurance. It is celebrated every September, and the event revolves around insurance-related conversations. However, some individuals may find it uncomfortable since you talk about leaving loved ones behind.

Hence, we ensure that when we tackle these issues, we do it with care and empathy. We all know our loved ones are more important than anything else, so it’s always best to approach these conversations professionally and carefully. Overall, we aim to foster healthy and productive discussions regarding insurance and the components that go along with it.

Famous Insurance Agencies You Need To Know

When engaging in insurance, it’s essential to recognize the Insurance agencies that do it best. However, choosing the best insurance agencies is subjective since these agencies may excel in various areas, such as customer service, affordability, financial stability, and policy offerings. Moreover, these agencies have unique backgrounds and achievements in today’s world.

Here are a list of agencies and what they can offer that might interest you:

New York Life

New York Life is one of the oldest and most respected life insurance companies worldwide. They offer a variety of life insurance policies such as whole life, term life and universal life. This agency is also known for its financial strength, excellent customer service, and a wide range of policy customization options for its customers.

Prudential Financial

It is an American life insurance company considered one of the largest in the United States. Prudential Financial also offers a wide range of insurance products like term, whole, and universal life. They’re known for their strong financial stability and a variety of investment options available within their policies.

Northwestern Mutual

Northwestern Mutual is an American financial services mutual organization based in Milwaukee, Wisconsin. It was founded in 1857 and is known to specialize in whole life insurance and also places a strong emphasis on financial planning and guidance. Additionally, Northwestern Mutual offers a dividend-paying whole-life policy that provides potential cash value growth.

MetLife

It is a familiar name to our ears, and we also see their building whenever we’re strolling around Manhattan. MetLife is an agency headquartered in New York. It is among the largest global providers of insurance, annuities, and employee benefit programs. The agency has 90 million customers in over 60 countries with various insurance solutions for their customers.

AXA

On the other hand, AXA is a French multinational insurance company with its headquarters in the 8th arrondissement of Paris. They also pride themselves in providing various financial services and investment management. AXA operates mainly in Western Europe, North America, and more, with a presence in Africa.

The Benefits of Life Insurance

Now that you’ve heard about some renowned insurance agencies, it’s time to take a step closer and learn why life insurance is essential and beneficial. 52% of Americans have individual and workplace life insurance, according to the Life Insurance Marketing and Research Association (LIMRA). Plenty of individuals have found insurance to be a life protection that covers several expenses, thus making their lives better and more manageable.

Here are reasons why life insurance is beneficial:

Takes care of your loved ones even in your absence

When death happens, the most common concern would be getting by financially. However, if you have life insurance, it’s a lot more manageable to deal with finances and daily essentials such as your child’s education, loans, debts, and plans on purchasing properties like cars and homes. Burdens will be lesser for your loved ones.

Manages your debt

Facing debts has always been stressful, and it becomes worse when death happens. While it feels like no one to run to, a proper insurance plan will help the whole family cope better, especially financially.

Helps your business

Life insurance helps provide funds to keep your business running even after the absence or death of an owner or key employee. The right insurance can help cover operating expenses, salaries, and other costs until your business stability.

The younger you are, the cheaper the insurance is

If you are a student, you might get educational loans by co-signing them with your parents or any attending guardian. When paying back these loans, consider purchasing the most suitable life insurance plan. Through your young age and good health, insurability is high while the premiums you will have to pay will be lower, too.

Complements your retirement goals

Investing in life insurance is similar to putting money into a pension scheme and enjoying what you have sown once you retire. Once you start investing in an insurance plan, you can expect a consistent monthly cash flow after retirement.

Overall, investing in the most suitable plan yields many long-term benefits such as the abovementioned ones. However, it’s best to inquire about insurance agencies to identify which plan best suits you and your conditions. Remember that insurance plans vary according to your needs, so seek advice from a financial advisor.

What to expect during LIAM?

During Life Insurance Awareness Month (LIAM), insurance agencies host various activities and initiatives to educate individuals about insurance. These activities foster insurance awareness and give people an overview of why insurance is helpful and recommended for you.

Seminars and Webinars

Insurance agencies, financial advisors, and various experts in the industry host seminars and webinars where they talk about insurance-related topics such as policy types, coverage options, and why insurance is generally beneficial and good for you. Participants can freely share their thoughts and ask questions in this activity.

Awareness Campaigns

Aside from healthy insurance-related discussions, you can also take the chance to witness TV/radio and social media commercials related to insurance. In addition, you can also expect print materials that revolve around insurance to be present at the event.

Community Outreach

Insurance agencies and financial advisors also organize and host community events where they can share their knowledge and experiences regarding insurance. Specifically, the community can expect workshops, Q&A sessions, and educational booths at the event.

Free Consultations

In the event, insurance professionals offer free consultations to help individuals assess their insurance needs. In most cases, professionals will cover personalized insurance assessments and recommendations. So, if you want to be guided better, this event is the perfect time to clear all your doubts and concerns regarding insurance.

Employee Engagement

Aside from regular citizens, company employees will also be able to learn their goals better. In the event, company leaders will also emphasize educating their workforce with chunks of knowledge, specifically focusing on coverage options and insurance benefits.

Social Media Campaigns

LIAM also extends its awareness on social media. Hashtags like #LIAM or #LifeInsuranceAwarenessMonth usually accompany it. It aims to share educational content, stories, and testimonials to reach a broader audience.

Available Online Tools

Some insurance agencies offer available tools and calculators on their websites that individuals can use to estimate their insurance needs and premiums. In this way, it’ll be easier and more convenient for individuals to understand the cost of coverage.

Securing Your Family’s Future with Insurance Agencies : Join The Cook Group Today!

Understandably, discussing and mentioning death will never be pleasing to our ears. However, if you look at the positive and practical sides of insurance, it does uplift people’s lives. Generally, insurance is deemed as a financial protection that covers specific coverages and helps you get by better financially. But it’s recommended that you learn what it is first.

There are countless insurance agencies, and each of them offers different insurance products. So, you need to evaluate your financial goals and conditions first before starting an investment. In LIAM, you can take the fantastic chance to learn more about insurance and the effects you can benefit from it. Happy Life Insurance Awareness Month!

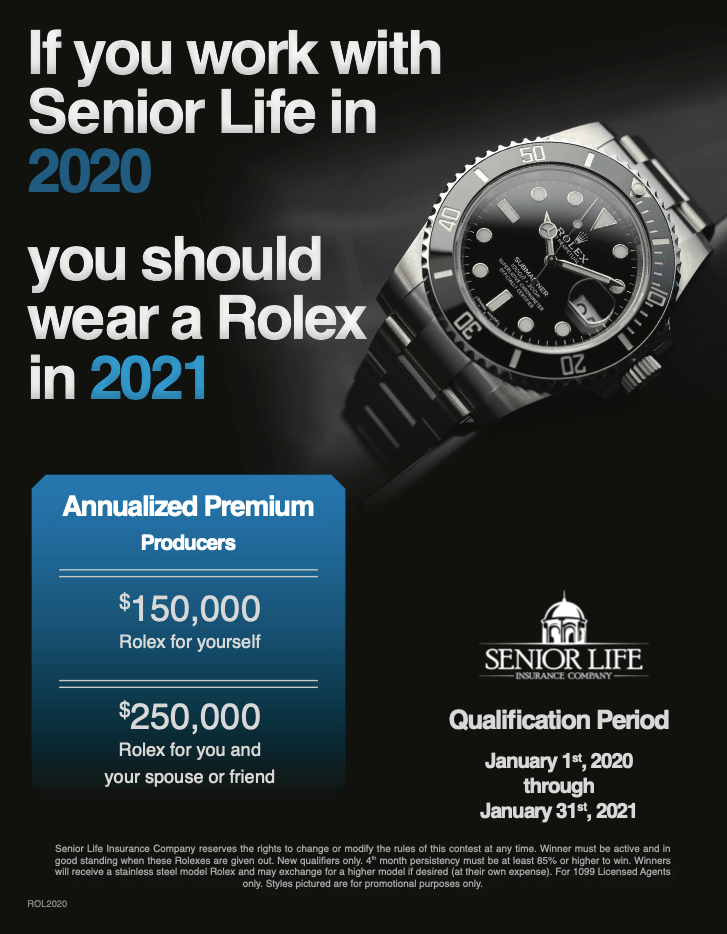

With Senior Life Insurance Company, you have the chance to earn your own Senior Life Insurance Company ring based on your production.

With Senior Life Insurance Company, you have the chance to earn your own Senior Life Insurance Company ring based on your production.