The insurance industry plays a vital role in protecting individuals and businesses from financial risks. Behind this industry are dedicated professionals known as insurance agents. If you’re considering a career as an insurance agent, this comprehensive guide provides valuable insights and tips on how to become an insurance agent for success in this rewarding field.

What is an Insurance Agent?

An insurance agent is a professional who serves as a representative of an insurance company. Their primary role is to assist individuals and businesses in understanding their insurance needs and finding suitable coverage options.

Insurance agents evaluate clients’ risks, assets, and financial situations to determine the type and amount of coverage required to protect them adequately. They also help clients complete application forms and facilitate the submission process to the insurance company.

Importance of the Insurance Industry in Today’s World

The insurance industry plays a crucial role in society by managing risks and providing financial protection against unforeseen events.

- Insurance contributes to economic stability by diversifying risks and providing stability in times of uncertainty.

- Life insurance offers individuals the opportunity to save and invest in the long term.

- The insurance industry is incorporating technology into its operations, expanding its reach to a wider range of potential clients.

- The growing demand for insurance and the industry’s adaptability present numerous opportunities for success.

- To become an insurance agent, it is important to understand these key aspects of the insurance industry.

Steps to Become an Insurance Agent

Here are the following steps of how to become an insurance agent, you must accomplish the following:

Research and Understand Licensing Requirements

Begin by familiarizing yourself with the licensing requirements specific to your location. Each jurisdiction has its own regulations, which may involve completing pre-licensing education and passing an examination.

Complete the Necessary Education and Training

Enroll in accredited insurance courses or programs to gain the knowledge and skills required for the profession.

Pass the Licensing Exam

Prepare diligently for the licensing exam by studying the relevant materials and taking practice tests.

Obtain Required Certifications

Depending on the type of insurance you plan to specialize in, additional certifications may be necessary. Research and pursue relevant certifications to enhance your expertise.

Consider Professional Development Opportunities

Continuously invest in your professional growth by attending workshops, seminars, and industry conferences to stay updated with the latest industry trends and developments.

Skills Needed in an Insurance Agent Role

One of the tips for becoming a successful insurance agent is to practice these skills and develop a specialty within the role. Combine these skills with a specific field within the industry.

These skills may include:

Communication Skills

Having good communication skills is one of the most important abilities you need to develop. It allows you to effectively and clearly communicate with both clients and providers. You should be able to provide and simplify insurance details that are relevant and understandable for clients.

Analytical and Problem-Solving Skills

As an insurance agent, you will encounter unique situations where clients have different needs and requirements. It is important to have strong analytical skills to analyze, study, and understand each client’s needs.

Agents should also have a sharp understanding to solve difficult cases and customize policies tailored to unique situations, ensuring clients’ requirements are met.

Technology Proficiency

Insurance agents should be open-minded and comfortable with using technology in their field. You need to be experienced and knowledgeable in utilizing various technologies, as they can provide some level of ease to your workload.

Knowledge of Insurance Products

As an insurance agent, part of your role involves representing the provider and selling their policies. Therefore, you need to be aware and knowledgeable about the products and services offered by the provider. This knowledge will help you identify affordable policies that suit different clients’ needs.

Building a Strong Foundation

Develop a Comprehensive Understanding of Insurance Products and Coverages:

- Acquire in-depth knowledge of various insurance products and their specific coverages.

- Familiarize Yourself with the Insurance Market and Industry Trends

- Be aware of market dynamics that may impact the insurance landscape.

- Establish connections with industry professionals such as agents, brokers, and underwriters.

- Networking can lead to valuable referrals and mentorship opportunities.

- Seek internships or entry-level positions within insurance agencies.

- Obtain hands-on experience to understand the nuances of the insurance business.

By following these steps, aspiring insurance agents can develop a strong foundation of knowledge, stay informed about industry trends, establish a network of connections, and gain practical experience to succeed in their insurance careers.

Secrets to Success as an Insurance Agent

Here are some additional tips that will give you an edge in achieving success as an insurance agent:

Building a Strong Network

Developing a strong network is crucial to becoming a successful agent. Expand your client base and generate referrals to attract more potential buyers. Cultivating relationships can lead to valuable connections and business opportunities. Actively engage with individuals in related fields by attending events and joining associations.

Specialize in a Niche

Consider developing specialized expertise in a specific niche within the insurance industry. Having specialties allows you to become an expert in particular areas and cater to a wider range of clients.

Invest in Marketing

Develop effective marketing strategies to promote your services. Utilize both online and physical marketing options, such as social media advertising and local sponsorships, to attract potential clients.

Continuously Seek New Clients

Aim to acquire new clients to enhance your experience and business growth. Attend multiple industry events, participate in community activities, and leverage referrals to connect with new potential clients.

Effective Strategies for Success

- Develop Strong Client Relationships and Provide Excellent Customer Service: Build trust with your clients by actively listening to their needs, offering personalized solutions, and providing prompt and reliable service.

- Utilize Effective Marketing and Sales Techniques: Implement targeted marketing strategies to reach potential clients and leverage your sales skills to effectively communicate the value of insurance products.

- Continuously Expand Knowledge: Stay updated on industry changes, new products, and emerging risks. Take advantage of educational resources and professional development opportunities to enhance your expertise.

- Build Your Personal Brand and Reputation: Establish a strong personal brand by consistently delivering exceptional service and demonstrating professionalism, integrity, and expertise.

Overcoming Challenges in the Insurance Industry

The insurance industry, like any other, presents its own set of challenges. To succeed as an insurance agent, it’s important to navigate these challenges effectively. Here are some strategies for overcoming common challenges in the insurance industry:

Handling Rejection

Understand that while insurance policies are in high demand, some individuals may require multiple opinions before making a decision. Learn how to accept rejection as part of your learning experience and use it to further develop your skills and approach.

Navigating Complex Industry Regulations and Compliance

Develop a comprehensive understanding of the rules and regulations within your field. Communicate them to clients in a simplified manner. Understanding compliance requirements will help you avoid issues and ensure smooth operations.

Dealing with Competition and Market Saturation

Continuously learn and gain more work experience to improve your skills. Build your expertise and experience to thrive in the competitive market.

Managing Client Expectations and Delivering on Promises

Handle multiple client requests and manage them in a timely manner. Use calendars and app notifications to stay organized and ensure timely completion of tasks.

Adapting to Evolving Customer Preferences and Needs

Stay updated with changing trends and preferences in the industry. Adapt your sales approach accordingly to stay relevant and thrive in the competitive market.

Maximizing Your Potential as an Insurance Agent: Join Us Today!

Becoming an insurance agent offers a rewarding career path with numerous opportunities for growth and success. With the right skills, knowledge, and dedication, individuals can thrive in the insurance industry and make a positive impact on the lives of clients.

If you are looking to embark on a rewarding journey as an insurance agent, we invite you to join The Cook Group Insurance today. Take the first step towards a successful career by exploring the opportunities and benefits that await you. Join our team today and unlock your potential in the insurance industry.

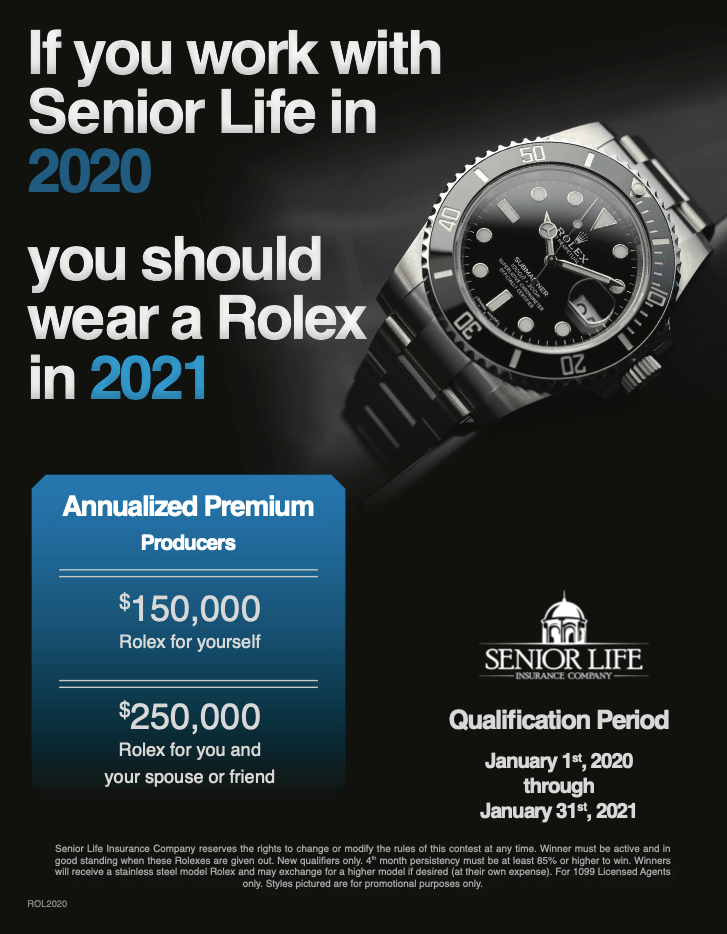

With Senior Life Insurance Company, you have the chance to earn your own Senior Life Insurance Company ring based on your production.

With Senior Life Insurance Company, you have the chance to earn your own Senior Life Insurance Company ring based on your production.