Business identity for insurance agencies is important as specific characteristics are needed in defining a company within the market. Business identity revolves around various elements that shape how an agency is perceived by its target audience and unique services.

The Importance of The Agency’s Identity

Certain factors make brand identity important for insurance agencies. It is worth noting that when it comes to building these agencies, it should be properly done to promote the business best. A well-promoted business will result in garnering individuals who are interested in availing the service. At its core, business identity helps shape the agency’s branding, including the name, logo, tagline, and overall visual identity.

That said, these agencies want to build their identities that are reliable, trustworthy and dependable in the long run. Here are how the factors of business identity help insurance agencies stand out from time to time.

Establishing Credibility and Trust

Business identity helps build trust within insurance agencies, serving as the agencies’ face and personality. A strong brand presence, logo, and messaging are a strong introduction to clients looking for insurance products.

Business identity helps foster credibility for insurance agencies. A well-strategized identity reassures clients that the agency understands and meets their unique insurance needs. A strong identity also develops a strong commitment to professionalism and ethical conduct.

Ethical conduct at the professional level helps strengthen the agency’s credibility as a trustworthy partner towards a wide range of agents. By establishing a credible and trustworthy identity, agencies are able to drive potential clients to avail their insurance services.

In addition to that, it can also help in leading the fierce competition in the industry as more and more are eager to deliver insurance services to clients. Standing out in comparison to your competition is a winning factor as the agency will be more recognized by the target audience.

Differentiation in a Competitive Market

The field of the insurance industry is intensely competitive. There are a range of insurance agencies that offer a wide array of products and services to identical consumers and businesses.

This competition is driven by different choices, prices, and service qualities, which drives insurance agencies to develop effective approaches.

Business identity helps make different insurance agencies stand out in such a competitive market. An agency’s branding, values, and mission develop a strong appearance that makes it unique and defined.

Leveraging identity gives insurance agencies the edge in aligning their identity with their target market’s needs and preferences. A unique identity helps these agencies stand out by offering specialized solutions and exceptional products.

Creating a Consistent Brand Image

A consistent brand identity encompasses several key elements that convey and align the agency’s personality, mission, and services toward clients and partners. Visual elements help reflect the agency’s messaging and values.

These visuals usually comprises of:

- The agency’s logo

- Choice of color schemes

- Elemental choices and design

While it may sound off topic in focusing on developing your brand’s appearance, this is what gets the attention of any potential client. Clients are looking to see how well a business can handle their concern.

Successful insurance businesses display how well they serve their customers on their brand image. If a business only has a mediocre image, this will give the impression that they are less experienced and unable to handle a client’s difficult case.

Fostering Client Relationships

Insurance agencies need to have a deep connection with their clients who are looking for an insurance provider that offers what they are looking for. It is essential for insurance agents to deeply understand their target audiences through data and insights.

They would also need to provide their skills in order to work with clients and offer tailored services and solutions. Additionally, fostering a good connection with the target clients creates a sense of trust and reliability.

An agency’s identity helps convey the agency’s unique commitment, ethical practices, and specific values toward clients. Maintaining long-term client loyalty serves many benefits for an insurance agency.

This gives the agency an audience where they can provide their insurance products. Providing tailored services and products that match any personal needs serves as a means of effectively rewarding and retaining clients.

Effective Marketing and Communication

Insurance agencies depend on business identity and branding to streamline their marketing efforts. This provides a clear and consistent foundation for the agency’s marketing activities and reduces the risk of mixed messages.

Effective marketing relies on developing compelling approaches that reflect the agency’s identity. The agency’s goal, core values, and selling offers should be able to stand out and communicate well to their audience.

Agencies need to build their business identity robust and long-lasting in order to showcase consistency. This includes both traditional methods and using digital platforms in reaching out to potential clients.

Clients are more interested towards agencies that communicate well in terms of marketing and understanding regarding life insurances. Agents will need to live up to client expectations by understanding what they are trying to achieve and what they are selling to them.

Traditional Advertising Approaches

For traditional advertising approaches, insurance agencies rely on print media to market themselves before implementing digital processes. They would advertise themselves in newspapers and other print media.

Another common method is through booths or door-to-door advertising, where insurance agents would physically be in a location or neighborhood and promote their insurance plans to a listening audience. This is one of the more common approaches used as door-to-door sales would result in more results and interests for more direct clients.

Furthermore, insurance agencies develop network connections with fellow communities and build strong connections with potential partners. These connections would help them spread across their other partners and provide them with the agencies’ selling points.

Trends in Business Identity

In the future, there will be several emerging trends that will greatly leave impacts towards insurance agencies. Trends offer any industry the opportunity to adapt and grow. One of the most notable trends is the notable growth and development of digital branding, which also includes online branding. More customers will engage with any product through digital marketing, with traditional means slowly decreasing in favor of the former.

Insurance agencies need to take this opportunity to build their brand identity to fit the digital landscape. Digital integration has already made several changes and streamlined business operations to successful levels. Building an identity brand within the digital landscape would result in an in-depth and engaged customer experience. This also opens agencies to adopting socially conscious elements into their identity.

Another trend is how many target audiences are leaning toward obtaining insurance policies online. Shopping for insurance policies online gives people the ability to compare plans from different providers and have in-depth details in choosing the right plans.

Insurance agencies and the agents within should be adaptable in using these trends in their favor and market their policies in the digital market. Their services need to be precise and comprehensible for potential clients to understand and interest them. Furthermore, insurance agents would still need to be marketed in order to give further details to clients who are not too familiar with the policy’s entirety.

Final Thoughts

In a summarized concept, insurance agencies’ identity relies on building the right image and developing the best messaging. A well-built identity helps them cater to their target audiences, which are individuals who need financial protection. Insurance agencies provide many insurance policies that range from generalized to tailored plans. These products and services help them stay relevant and sought out by a wide audience ranging from seniors to businesses.

Insurance agencies are adaptable in order to stay on top in a competitive market, with some offering unique services compared to the rest. The Cook Group is an insurance agency that fully consists of agents with a wide range of experts who can provide in-depth knowledge. These agents will be your partners in navigating the right policies and clearing out the complicated parts of insurance.

A full-agent driven agency ensures that everything from details of insurance to services are provided by those who clearly know what it’s all about. Our team of insurance agents are dedicated to providing clients with the best experience on their journey to obtaining life insurance for their future plans. With us, you and your family’s future are in safe hands. Consider joining our team today and begin your journey in helping these clients out.

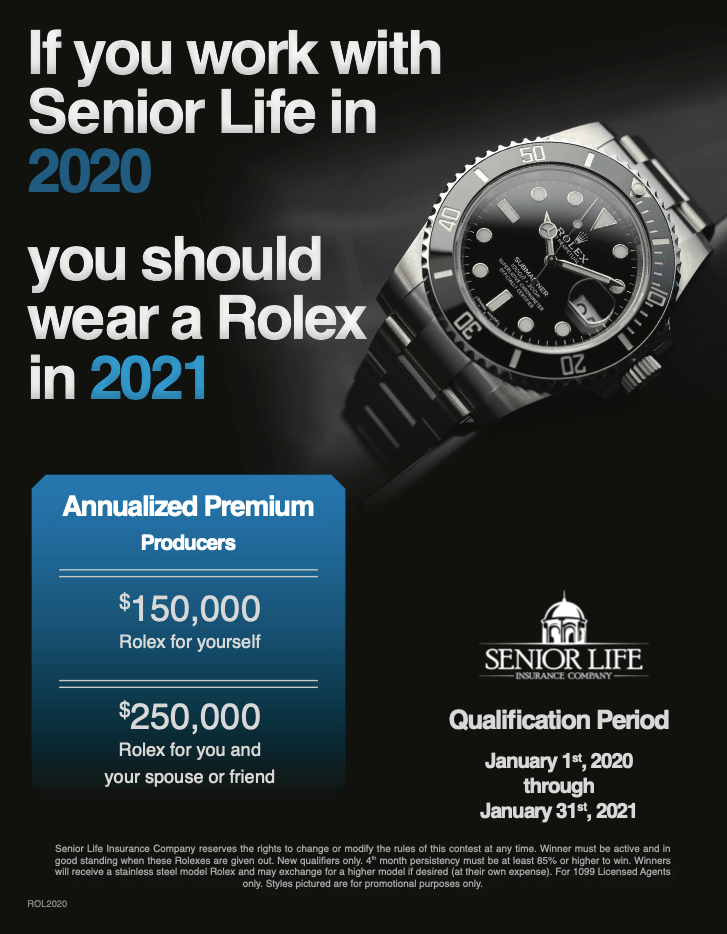

With Senior Life Insurance Company, you have the chance to earn your own Senior Life Insurance Company ring based on your production.

With Senior Life Insurance Company, you have the chance to earn your own Senior Life Insurance Company ring based on your production.